The K line is drawn by the four price levels formed by the product price in a certain period of time: opening price, closing price, highest price, and lowest price. ...

Classic rising K line pattern will appear repeatedly. If you master the meaning of these combinations, your trading will be greatly improved. When a rising K line combination appears, it tells you that the price will rise soon, stop ...

Classic Falling K-line pattern will appear repeatedly. If you master the meaning of these combinations, your trading will be greatly improved. When a falling K line combination appears, it tells you that the price will fall soon, to st...

p {box-sizing: border-box; line-height: 22px; font-family: open sans , sans-serif; font-size: 16px; margin: 0px;} As we all know, the most important thing of CFD trading is to predict the price trend of the product. Based on the prediction, we set up long or sh...

Price chart classification According to different time period, price chart can be divided into line chart, minute chart, hour chart, daily chart, weekly chart and monthly chart, etc. The chart of different time period has i...

For prices, there are only three trends : 1. Price rise 2. Prices fall 3. Price shock, that is, the price has no obvious upward or downward trend. In each case, we can buy and sell to obtain profit from the price diffe...

For prices, there are only three trends : 1. Price rise 2. Prices fall 3. Price shock, that is, the price has no obvious upward or downward trend. In each case, we can buy and sell to obtain profit from the price diffe...

For prices, there are only three trends : 1. Price rise 2. Prices fall 3. Price shock, that is, the price has no obvious upward or downward trend. In each case, we can buy and sell to obtain profit from the price diffe...

The shock trend accounts for the largest proportion of the three major market trends. 70% of the price movements in a year are shock trend, so a well understanding of the shock trend conducive to our investment. The features of shock trend: price fluc...

The shock market accounts for the largest proportion of the market, and it is expected that 70% of the price fluctuations will be the shock market. For investors, the shock market has many trading opportunities and risks under control...

When the price of a product falls, we can make a profit through continuous selling transactions. Observe the chart characteristics of the falling market, there are many opportunities to sell : 1. When ...

When the price of a product rises, we can make a profit through continuous buying transactions. Observe the key points of the price chart of the rising market, there are many opportunities to buy: 1. When the decline has ...

Since the beginning of this year, the investment market has performed gratifyingly. Gold rose from $1450 to $2000, an increase of 30%. Crude oil fell from $66 to negative price, and then rebounded to the current $45. Many celebrity st...

CFD tradings are all margin tradings. Margin trading means that investors use the leverage provided by the trading platform to calculate the margin required for trading. Margin trading is an investment method in which only part of th...

Spread: The price difference between the ask price and the bid price. When you trading, there is a price difference between the buying price and selling price of products. For example, the price of Gold (XAUUSD) is : ...

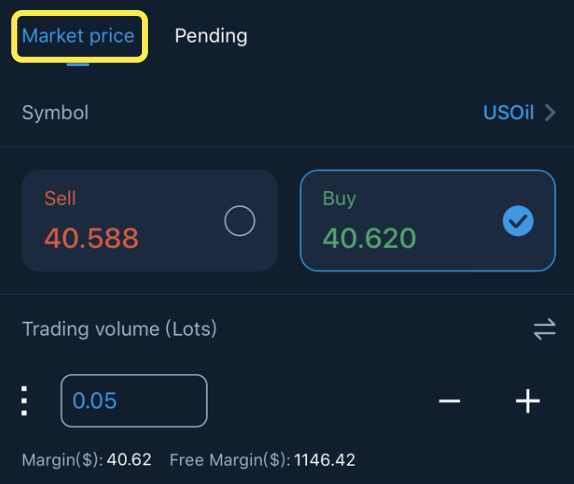

Open a position is also called create an order, which means that a trader newly buys or sells a certain number of contracts. Open a position is divided into open a position on current market price and open a position in limit orders. ...

Close a position refers to a trader buys or sells a contract with the same quantity and symbol but the opposite direction of the contract. Close a position is divided into close on current market price and close in limit order ...

An order placed by the trader to the broker and executed when the market quotation reaches the preset price. There are 4 ways of pending orders 1. Buy Limit Preset a price lower than the current price for pend...

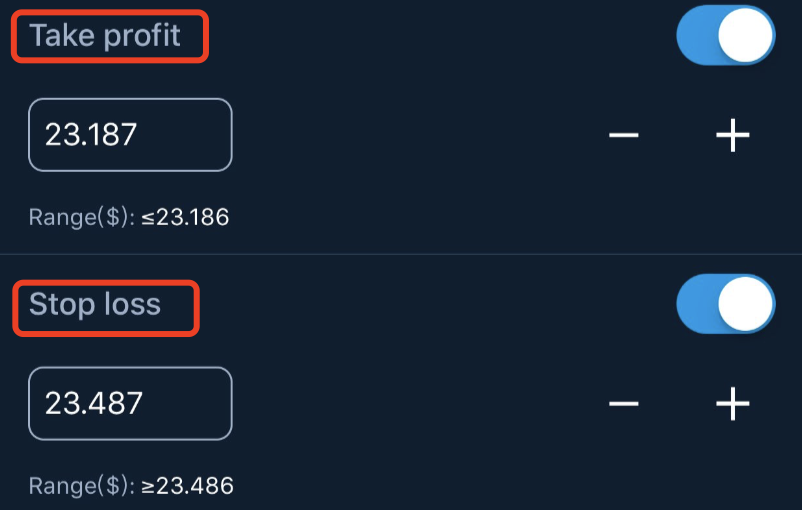

Take Profit Setting of take profit will assist trader in locking in the desired amount of profit. After trader presets an order to obtain profit, If the market price reaches the preset price set by the trader, the position will be executed and ...

The foreign exchange market is a global decentralized or over-the-counter (OTC) market for the trading of currencies. This market determines foreign exchange rates for every currency. It includes all aspects of buying, selling, and ex...

English

English

简体中文

简体中文

Tiếng Việt

Tiếng Việt

Malay

Malay

Indonesia

Indonesia

Deutsch

Deutsch

Français

Français

Español

Español

Italiano

Italiano