K line detailed introduction

2021-07-05The K line is drawn by the four price levels formed by the product price in a certain period of time: opening price,

closing price, highest price, and lowest price.

If the price goes up and the closing price is higher than the opening price, it is indicated in green, which is called

positive line; on the contrary, when the price falls and the closing price is lower than the opening price, it is

indicated in red and it is called negative line. K lines are divided by time period, including minute K lines, hour K

lines, daily K lines, weekly K lines, monthly K lines, annual K lines, etc.;

Different price trends are drawn into various types of K lines. Here are a few classic one:

1. Bald positive line and Bald negative line

「A」 Bald positive line: the opening price is close to the lowest price of the day, and then the price rises all the way

to the highest price to close, indicating that the market buyers are enthusiastic and the upward trend is not exhausted;

「B」 Bald negative line: The opening price was close to the highest price of the day, and then the price fell all the way

to the lowest closing price, indicating that the market is down strongly, especially in the high price area, which is

more dangerous;

2.Small positive line and Small negative line

「C」 Small positive line: the green body is short, which means that buyer are dominant, and the upward trend will

generally continue;

「D」Small negative line: the red body is shorter, indicating that the seller are dominant, and the downward trend will

generally continue;

3.Big positive line and Big negative line

「E」Big positive line : the green body is long, and the single k-line has increased by more than 5%. At this time, long

investors defeated the shorts and gained an overwhelming advantage. The buyer's market is relatively active, and the

market outlook is very likely to continue to rise;

「F」Big negative line: the read body is long, and the single k-line has fallen by more than 5%. At this time, short

investors beat the longs and gained an overwhelming advantage. The seller's market is relatively active, and the market

outlook is very likely to continue to fall;

4. Cross line

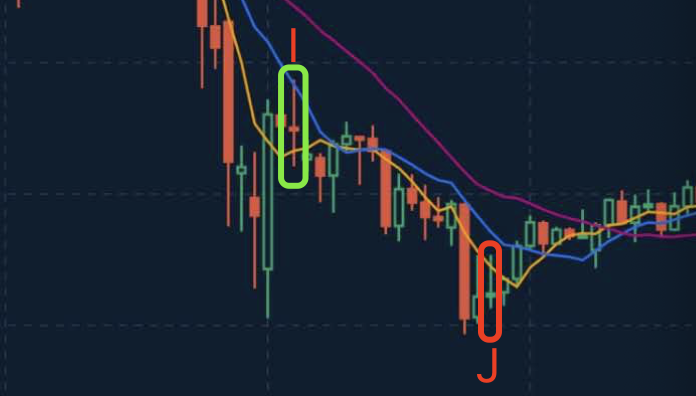

「I」「J」 Cross line: both buyers and sellers are evenly matched and the trend is stable; but in a strong market, the cross

line often becomes the reversal between uptrend and downtrend;

5. Upper shadow line and Lower shadow line

「K」 Upper shadow line on L: the price once rose sharply, but fell again under the pressure of selling, and closed at the

lowest price, which is a weak form;

「L」 Lower shadow line: the price once dropped sharply, but rise again upon the support of buying, and closed at the

highest price, which is a strong form;

6. Hammer line and inverted hammer line

「M」 Inverted hammer line: the price rises but then falls back, the uptrend is suppressed. Although the closing price is

still higher than the opening price, there is a resistance above it;

「N」 Hammer line: the price fell but rebounded, the downtrend is supported. Although the closing price is lower than the

opening price, there is a support below it.

The K line is drawn by the four price levels formed by the product price in a certain period of time: opening price,

closing price, highest price, and lowest price.

If the price goes up and the closing price is higher than the opening price, it is indicated in green, which is called

positive line; on the contrary, when the price falls and the closing price is lower than the opening price, it is

indicated in red and it is called negative line. K lines are divided by time period, including minute K lines, hour K

lines, daily K lines, weekly K lines, monthly K lines, annual K lines, etc.;

Different price trends are drawn into various types of K lines. Here are a few classic one:

1. Bald positive line and Bald negative line

「A」 Bald positive line: the opening price is close to the lowest price of the day, and then the price rises all the way

to the highest price to close, indicating that the market buyers are enthusiastic and the upward trend is not exhausted;

「B」 Bald negative line: The opening price was close to the highest price of the day, and then the price fell all the way

to the lowest closing price, indicating that the market is down strongly, especially in the high price area, which is

more dangerous;

2.Small positive line and Small negative line

「C」 Small positive line: the green body is short, which means that buyer are dominant, and the upward trend will

generally continue;

「D」Small negative line: the red body is shorter, indicating that the seller are dominant, and the downward trend will

generally continue;

3.Big positive line and Big negative line

「E」Big positive line : the green body is long, and the single k-line has increased by more than 5%. At this time, long

investors defeated the shorts and gained an overwhelming advantage. The buyer's market is relatively active, and the

market outlook is very likely to continue to rise;

「F」Big negative line: the read body is long, and the single k-line has fallen by more than 5%. At this time, short

investors beat the longs and gained an overwhelming advantage. The seller's market is relatively active, and the market

outlook is very likely to continue to fall;

4. Cross line

「I」「J」 Cross line: both buyers and sellers are evenly matched and the trend is stable; but in a strong market, the cross

line often becomes the reversal between uptrend and downtrend;

5. Upper shadow line and Lower shadow line

「K」 Upper shadow line on L: the price once rose sharply, but fell again under the pressure of selling, and closed at the

lowest price, which is a weak form;

「L」 Lower shadow line: the price once dropped sharply, but rise again upon the support of buying, and closed at the

highest price, which is a strong form;

6. Hammer line and inverted hammer line

「M」 Inverted hammer line: the price rises but then falls back, the uptrend is suppressed. Although the closing price is

still higher than the opening price, there is a resistance above it;

「N」 Hammer line: the price fell but rebounded, the downtrend is supported. Although the closing price is lower than the

opening price, there is a support below it.

English

English

简体中文

简体中文

Tiếng Việt

Tiếng Việt

Malay

Malay

Indonesia

Indonesia

Deutsch

Deutsch

Français

Français

Español

Español

Italiano

Italiano