The Head and Shoulder Bottom Pattern

2021-07-05The Head and Shoulder Bottom Pattern occurs during a downtrend and marks its end. This chart pattern shows three lows, with two retracements in between.

How to Trade This Pattern?

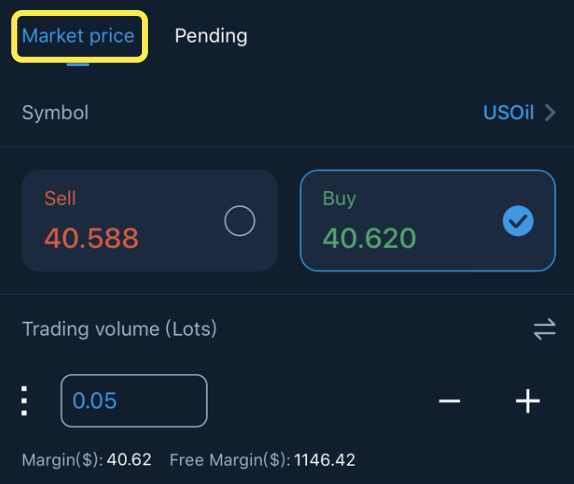

On the pictured chart, the pattern completes when the price breakout the neckline. It shows the transition from a downward trend to an upward trend. Short positions would better close out.

You would trade by entering long positions when the price moves above the neckline. Also place a stop-loss order just below the low point of the right shoulder.

The pattern also provides price targets. You can subtract the low price of the head from the high price of the retracements. This gives you the height of the pattern. Then establish the profit target based on the height of the pattern added to the breakout price.

When price is in a downward trend for a period of time, we must observe carefully whether there is a head and shoulder bottom pattern. Once seize the opportunity, there will be a big successful transaction.

English

English

简体中文

简体中文

Tiếng Việt

Tiếng Việt

Malay

Malay

Indonesia

Indonesia

Deutsch

Deutsch

Français

Français

Español

Español

Italiano

Italiano