How to Invest With Dollar Devaluation

2021-07-05

President Trump tested positive for Covid-19 as the election approaches. Investors must brace for a turbulent October in the market.

The U.S. dollar devaluated recently, and the market is still in a bit of a risk-on mood right now.

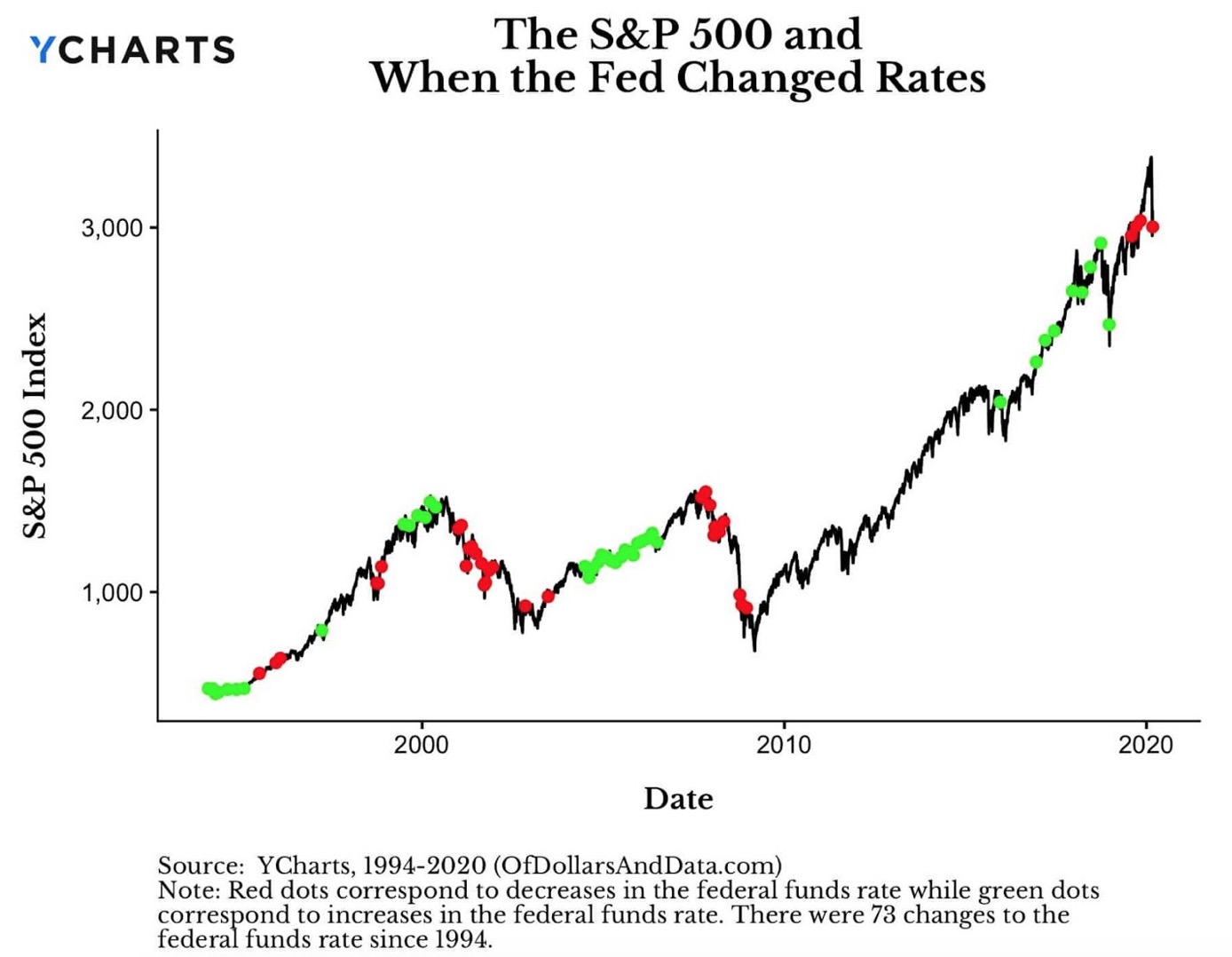

In 2020, the U.S. Federal Reserve kept its benchmark interest rate unchanged at a record-low level of near-zero to bolster the wavering recovery.

The Fed policymakers signaled near-zero interest rates would last through 2023 to aid the U.S. economy on its rebound from the coronavirus shutdown.

The Fed policymakers signaled near-zero interest rates would last through 2023 to aid the U.S. economy on its rebound from the coronavirus shutdown.

Some analysts believe that the U.S. dollar may face a prolonged devaluation due to the continuous powerful monetary easing, the pressure of U.S. government's debt, the rising of the Euro, and the US-China relationship, etc.

Goldman Sachs put a spotlight on the growing concern over inflation in the U.S. by issuing a bold warning July that the dollar is in danger of losing its status as the world's reserve currency.

While that view is still a minority one in most financial circles -- and the Goldman analysts don't say they believe it will necessarily happen -- it captures a nervous vibe that has infiltrated the market.

The dollar's decades-long position as the global reserve currency is in jeopardy because of steps the U.S. has taken to support its economy during the COVID-19 pandemic, according to Ray Dalio, founder of hedge fund giant Bridgewater Associates.

However, as the world's dominant currency, the U.S. dollar maintained its leading role in forex trading. The U.S. dollar was on the side of 88% of all trades last year, according to the latest survey by the Bank for International Settlements (BIS).

International Monetary Fund (IMF) statistics show that the U.S. dollar still accounts for about 62% of global foreign exchange reserves.

Hedging and Diversification

Investors have three options—stick to the original portfolio, ride out the currency fluctuations; shift into asset classes that tend to do better under a weakening dollar; or seek out investments designed to take advantage of a falling dollar.

The devaluation of the U.S. dollar may also trigger inflation, leading to higher commodity prices. Buying commodities is another way to hedge against inflation, especially precious metals such as gold, whose prices have soared recently.

Portfolio manager Robert Cohen, who oversees the Dynamic Precious Metals Fund, which outperformed 82% of its peers this year, argued that gold is a "nice safe" bet heading into the U.S. election in November, Bloomberg reports.

Along with ongoing Covid-19 concerns, the U.S. election is "probably the most contentious U.S. election since the Civil War," which could destabilize the U.S. market briefly regardless of who wins, Cohen told Bloomberg.

"I'm not sure how heavily I want to be invested heading into the election," he said, adding that gold would be a safe way to protect one's portfolio.

Investors have shifted into safe-haven assets after the aggressive central bank stimulus, lower real rates, massive fiscal stimulus, and ongoing economic-risks related to Covid-19, sending gold surging to record levels this year. Gold bullion touched an all-time high in August before falling sharply.

Gold prices saw a $200 tumble in September, which Wells Fargo is viewing as a great buying opportunity during a well-expected correction.

"We're buyers of gold," Wells Fargo head of real asset strategy John LaForge wrote on Monday. "After a great seven-month run, gold cooled off in August and September. Gold spot prices today sits about $200 lower than its all-time high of $2,075 per ounce set in August."

"Only five times since 1980 has gold seen 37%+ rallies in such a short amount of time. These types of rallies are hard to hold onto, and gold was due to cool off some," LaForge explained.

Prior to September, the U.S. dollar was in a downtrend, which helped gold climb to its new record highs.

"Starting in early August, though, the U.S. dollar stopped moving lower. And in recent weeks, it has even started moving higher," LaForge said.

However, Wells Fargo's optimistic view on gold has not changed with the bank remaining bullish on the yellow metal.

"The fundamental backdrop looks good. Interest rates remain low, money supplies excessive (quantitative easing), and we are doubtful that the U.S. dollar's September rally has long legs," LaForge said. "We view gold at these prices as a good buying opportunity and, as evidenced by our 2021 year-end targets, expect higher gold prices."

English

English

简体中文

简体中文

Tiếng Việt

Tiếng Việt

Malay

Malay

Indonesia

Indonesia

Deutsch

Deutsch

Français

Français

Español

Español

Italiano

Italiano