Risk Management and Position Size

2021-07-05Most investors focus on how to find or develop a good trading strategy to make profits, but ignore what should do first. What more important is the Risk Management. It is the foundation of your transaction. Only protect your assets well, you can arrange the trading process to meet head-on the market.

What to do in Risk Management?

1. Always utilize a Stop Loss.Though the price moves in your forecast, it could reverse at any time. By having a stop loss means risk is controlled. Even if the price go opposite of your direction, there is only a minimal loss in this transaction.

When you set up a stop loss, determine how much you are willing to risk on one trade. If you can risk $100per trade, set up in each position, if the price moves opposite way, you lose $100. But if the price goes your direction, you would gain a mount of money. Don't be afraid of losses, because you have a fixed way of risk control, and the price not always in the opposite way. If that does, remember to take opposite position next time.

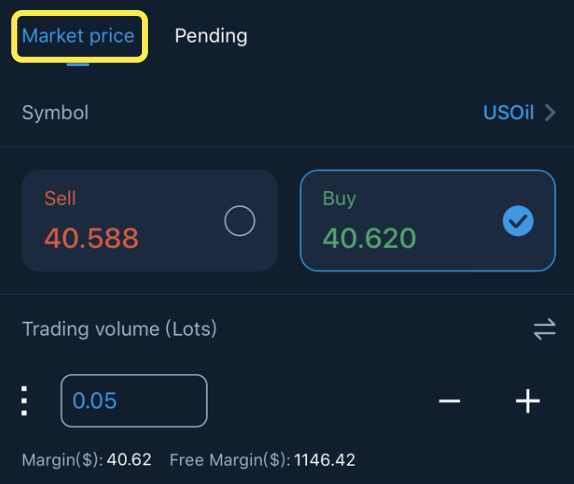

2. Calculate Position Size.Position size is how many lots are taken on a trade. To calculate the ideal position size, first mask out the stop loss price and enter price. The price difference between the two is the basis. Calculate the risk money of your stop loss divides by the price difference, there comes the position size.

For example, your risk money on per trade is $500. If your entry point is $50 and your stop loss is $49.5, then your risk is $0.5 per trade. To calculate how many lots you can take on your trade, divided $500 by $0.5. You can take a position size up to 1000 lots.

3. setting Reasonable profit targetIt's not easy to set a reasonable profit target. Investors want to maximize their profits, but conditions don’t cooperate all the time. The suggestion is that ever if you miss more profit and close your position too early to exit out, it doesn't mean you have done a failed deal. What more important is to get out in time and ensure the success rate.

You can see many articles on our platform in calculate profit targets. Refer to “the head and shoulder bottom pattern” or “the double top pattern”...There are many ways to set your profit target with the help of chart pattern, indicators.

Now we have the risk management, what you to carry out is the trade strategy. See more “trading strategy”,find out the one fit you!

English

English

简体中文

简体中文

Tiếng Việt

Tiếng Việt

Malay

Malay

Indonesia

Indonesia

Deutsch

Deutsch

Français

Français

Español

Español

Italiano

Italiano