Taking The Top 10 Biggest U.S. Market Crashes

2021-07-05As if worrying about the rapidly spreading coronavirus isn't taxing enough, we're also dealing with a full on-stock market crash.

On March 18, the circuit breaker was triggered after the U.S. S&P 500 Index fell more than 7% during intraday trading.

Just before this, on March 9, March 12, and March 16, the U.S. stock market had three plunges and circuit breakers. The three-day Dow Jones fell by 7.8%, 10.0%, and 12.9%, respectively.

Stock market crashes have happened before. There's much you can learn from previous market crashes that can help you personally and professionally, in addition to better managing your portfolio.

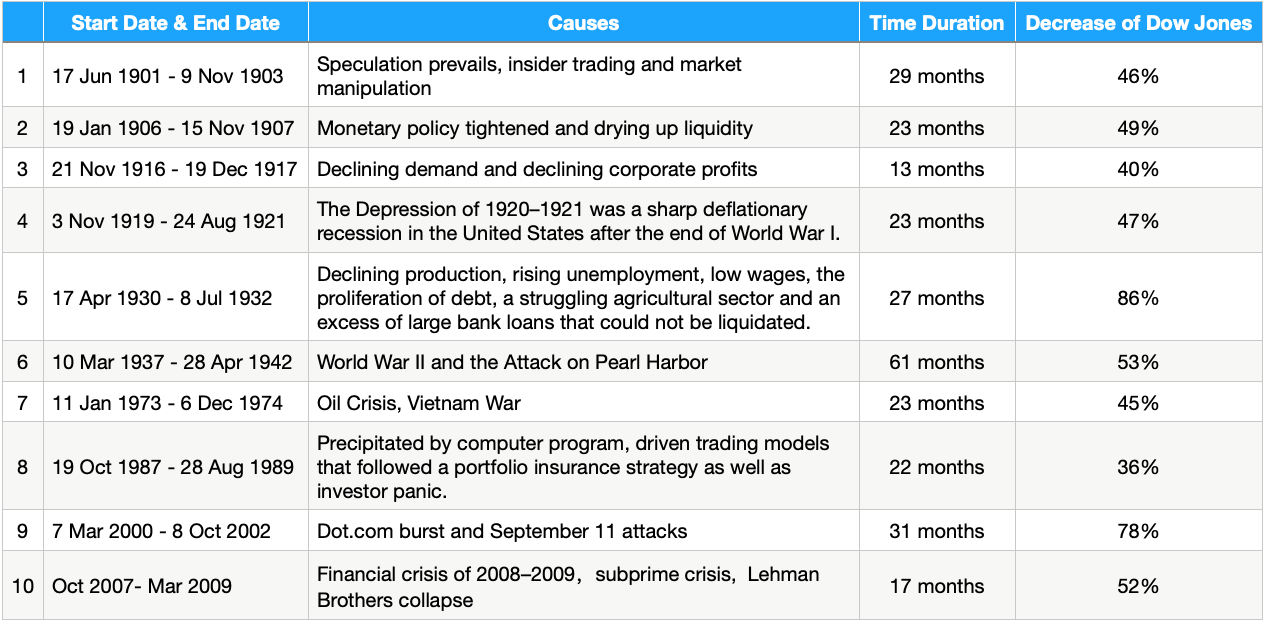

Within the past 100 years, we've had ten major stock market crashes.

The collapse of U.S. stocks is accompanied by an economic recession. Besides, the Fed tightening monetary policy, the rise in commodity prices, wars, and valuation bubbles may all cause the stock market to collapse.

Of these ten bear markets, the biggest decline was during the Great Depression in the 1930s, and the Dow Jones fell as much as 86%. Followed by the dot-com bubble burst in the early 21st century, Nasnak's decline has plummeted 78%.

The longest bear market lasted was the stock market crash during World War II, which lasted 61 months; the second was the dot-com bubble burst in the early 21st century, which lasted about 31 months.

Factors that led to the collapse of U.S. stocks

- 1. Liquidity Crisis

- 2. Stock market bubble

- 3. Black swan event: war or pandemic

A liquidity crisis is a simultaneous increase in demand and decrease in supply of liquidity across many financial institutions or other businesses.

At the root of a liquidity crisis are widespread maturity mismatching among banks and other businesses and a resulting lack of cash and other liquid assets when they are needed.

Liquidity crises can be triggered by large, negative economic shocks or by normal cyclical changes in the economy.

Looking back the U.S. stock market, the target interest rates of federal funds were relatively high, which made funds tend to leave the stock market. For example, before the stock market crash occurred in October 1987, the interest rate level had risen to 7.25%; when the dot-come bubble burst in the in 2000, the interest rate level rose to 6.5%; the subprime mortgage crisis broke out in 2008, and the federal funds rate rose from 1% in 2003 to 5.25% in 2007.

A stock market bubble is a type of economic bubble taking place in stock markets when market participants drive stock prices above their value in relation to some system of stock valuation.

(1) Dot-com bubble

The dot-com bubble, also known as the internet bubble, was a rapid rise in U.S. technology stock equity valuations fueled by investments in internet-based companies during the bull market in the late 1990s. During the dot-com bubble, the value of equity markets grew exponentially, with the technology-dominated Nasdaq index rising from under 1,000 to more than 5,000 between 1995 and 2000. In 2001 and through 2002, the bubble burst, with equities entering a bear market.

During the crash, many online shopping companies, such as Pets.com, Webvan, and Boo.com, and several communication companies, such as Worldcom, NorthPoint Communications, and Global Crossing, failed and shut down. Some companies, such as Cisco, whose stock declined by 86%,Amazon.com, and Qualcomm, lost a large portion of their market capitalization but survived.

(2) Housing bubble

The United States housing bubble was a real estate bubble affecting over half of the U.S. states. It was the impetus for the subprime mortgage crisis. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and reached new lows in 2012.

Increased foreclosure rates in 2006–2007 among U.S. homeowners led to a crisis in August 2008 for the subprime, Alt-A, collateralized debt obligation (CDO), mortgage, credit, hedge fund, and foreign bank markets.

Any collapse of the U.S. housing bubble has a direct impact not only on home valuations, but mortgage markets, home builders, real estate, home supply retail outlets, Wall Street hedge funds held by large institutional investors, and foreign banks, increasing the risk of a nationwide recession.

The Fed cut interest rates seven times throughout 2008, and interest rates reached an ultra-low level of 0-0.25% to combat the economic recession.

The war will have a great negative impact on stock prices. The government will mobilize countless resources during the war, and high taxes and high debt policies will severely weaken investor demand for stocks. The war caused investors to panic and convert their assets into gold and cash.

The day before the Japanese attack on Pearl Harbor, the Dow Jones fell by 25%; the day after the Japanese attack on Pearl Harbor, the stock market fell by 3.5%; since then, the stock market has fallen all the way and hit a record low on April 28, 1942.

The 2020 stock market crash occurred due to the COVID-19 pandemic, which is the most impactful pandemic since the flu pandemic of 1918. Rising fears and global economic shutdown due to the economic impact of the COVID-19 pandemic is believed to be the main cause of the stock market crash. However, many experts have argued that it is an 'accelerant' rather than a sole core reason behind the crash.

Conclusion

1. A stock market crash is an abrupt drop in stock prices, which may trigger a prolonged bear market or signal economic trouble ahead.

2. Market crashes can be made worse by fear in the market and herd behavior among panicked investors to sell.

3. Leverage increase stock market volatility, such as the stock market crash in 1929 and 1987.

4. Several measures have been put in place to prevent stock market crashes, including circuit breakers and trading curbs, to lessen the effect of a sudden crash. How do you know when a stock hit bottom?

While there is no way to know for sure when a stock has bottomed, there are a number of indications that a savvy investor can keep in mind.

Keeping an eye on the sector, your target stock is part of and noting how it performs relative to the broader market can help you discern a bottom.

Price and volume are important indicators that a stock is at a key inflection point, especially if volume starts to pick up steadily.

Consider going against whatever the general masses think: if everyone is gung-ho about a particular stock, it might be time to sell.

English

English

简体中文

简体中文

Tiếng Việt

Tiếng Việt

Malay

Malay

Indonesia

Indonesia

Deutsch

Deutsch

Français

Français

Español

Español

Italiano

Italiano