Stock VS. Index, which is more profitable

2021-07-05In 1988, an investor holding $100, if he participated in index investment, by June 2020, it would become $2280; if he bought bonds, it would become $884.8; if he bought gold, it would become $405.

If he does not make any investment, the purchasing power is measured by the basket of daily necessities and services used to calculate the CPI. Before he could buy 100 units, now he can only buy 46 units, and the purchasing power has dropped 54%.

In addition to investing in gold and stocks, index investment also seems to be a good choice.

Investing in Stocks

When you buy shares of stock in individual businesses, you become a part owner of the company. That means you should get a proportional share of the profits or losses depending upon the success of the business experiences.

For example, let's say the McDonald's Corp.earned $4.5 billion after taxes in profit, and the company's Board of Directors decides to mail $2,46 billion of this back to the company's stockholders in the form of a cash dividend. Because 1,010,368,852 shares are outstanding, this works out to $2.44 per share. If you owned 1,000 shares, you received $2,440 in cash. If you owned 1,000,000 shares, you received $2,440,000 in cash.

Investors who bought ownership in successful companies in the past have grown very rich. Imagine if you became part owner of Microsoft, Google, Berkshire Hathaway, Coca-Cola, Nike, eBay, Target, Disney, or American Express when they were small.

As their profits grew, you benefited based upon the total ownership you held.

On the other hand, companies fail. Sometimes, just like the American car manufacturers, they slowly atrophy. Other times, they end in a spectacularly catastrophic meltdown, like Enron. If you own stock in these companies, your shares might be worthless, just as if you owned a local bakery that had to shut its doors.

Investing in Index

Indices (also known as stock indexes) represent the value of a group of assets or stocks listed on a particular exchange.

Market indexes are used as important benchmarks in measuring various assets' returns, such as the stock market.

Since indices are just a number, they can't be traded directly. The investors need a financial instrument, like CFDs, for that. Indices trading is the most popular form of CFD trading.

Index investing is a passive investment strategy that seeks to replicate the returns of a benchmark index.

The amount of money made or lost on trade depends on the market move and your position's size.

The most-traded indices include the Dow Jones Industrial Average, TECH100, SP500, FTSE 100, CAC 40, and Dax 30, etc.

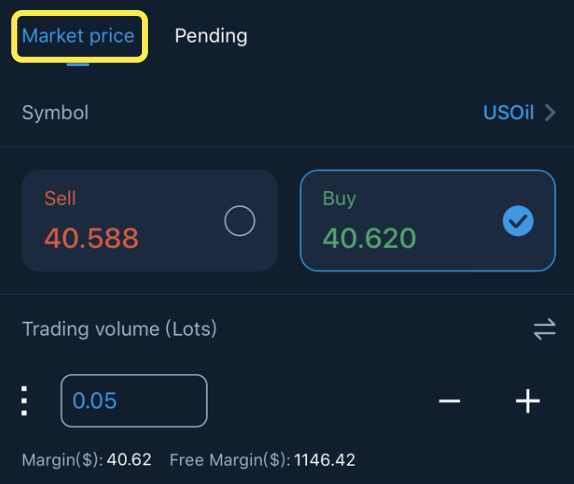

At our platform, we offer CFDs on most major global indices, including Germany 30, Australia 200 DJ30, SP500, TECH100, UK100, and China A50, etc.

At our platform, you can start trading indices with a starting capital of just $50.

When you buy an index, you are buying a basket of stocks designed to track a certain index, such as the Dow Jones Industrial Average or the S&P 500. In effect, investors who buy shares of an index fund own shares of stock in dozens, hundreds, or even thousands of different companies indirectly.

Someone who invests in an index is saying, "I know I'll miss the Walmarts and McDonald's of the world, but I will also avoid the Enrons and Worldcoms. I want to make money from corporate America by becoming part owner. My only goal is to earn a decent rate of return on my money so it will grow over time. I don't want to have to read annual reports and 10Ks, and I certainly don't want to master advanced finance and accounting."

Statistically speaking, 50% of stocks must be below average, and 50% of stocks must be above average. It is why so many index fund investors are so passionate about passive index fund investing. They don't have to spend more than a few hours each year looking over their portfolio. Whereas a stock investor in individual companies needs to be familiar with a company's business, its income statement, balance sheet, financial ratios, strategy, management, and more.

As a general rule, index investing is better than investing in individual stocks because it keeps costs low, removes the need to constantly study earnings reports from companies, and almost certainly results in being "average", which is far preferable to losing your hard-earned money in a bad investment.

Investors can use stock indexes as their core long-term investment positions, and then invest in individual stocks to find opportunities for excess returns.

English

English

简体中文

简体中文

Tiếng Việt

Tiếng Việt

Malay

Malay

Indonesia

Indonesia

Deutsch

Deutsch

Français

Français

Español

Español

Italiano

Italiano