Margin trading

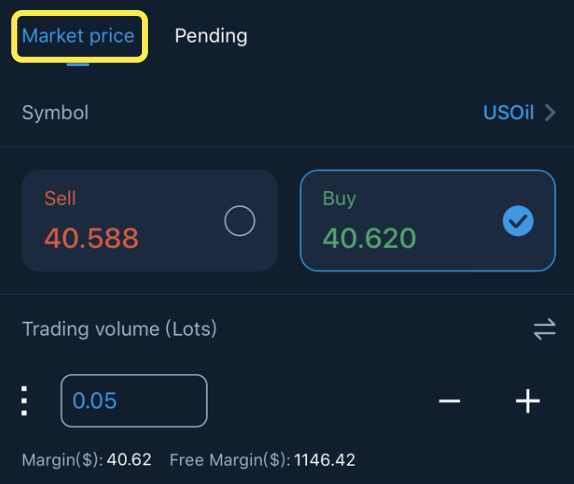

2021-07-05CFD tradings are all margin tradings.

Margin trading means that investors use the leverage provided by the trading platform to calculate the margin required for trading.

Margin trading is an investment method in which only part of the value of the investment target is used and

does not require full capital investment.

Margin calculation:

Margin = asset price * contracts volume * leverage

When it comes to margin trading, leverage has to be mentioned. In margin trading, due to different leverage, the required margin is also different. The greater the leverage, the less margin required for trading. Common leverages are: 1:100 1:200 1:500 1:1000

When trading $10,000 EUR/USD, the margin calculated by different leverage is different:

Leverage 1:100 The required trading margin is $100

Leverage 1:200 The required trading margin is $50

Leverage 1:500 Trading margin required $20

Leverage 1:1000 The required trading margin is $10

Margin trading makes full use of the leverage.

Using only a relatively small amount of funds can double the value of financial assets.

This enables investors with small amounts of funds to participate in the international investment markets such as foreign exchange and commodities.

For example, the margin of the euro to the dollar in our platform is 100%, and the leverage ratio is 1:100.

If you expects that the euro will rise and invest $1,000 to make long positions(buy),

you can buy total values $100,000 in euros by multiplying the 100 times leverage by $1,000 funds.

English

English

简体中文

简体中文

Tiếng Việt

Tiếng Việt

Malay

Malay

Indonesia

Indonesia

Deutsch

Deutsch

Français

Français

Español

Español

Italiano

Italiano