Global Rate Slashing. What Is a Rate Cut?

2021-07-05Reduction of Interest

Banks use interest rate adjustments to change the financial method of cash flow. When the bank cuts interest rates, the income from depositing funds in the bank decreases. Therefore, the interest rate cut will cause funds to flow out of the bank, and deposits will become investment or consumption. As a result, the liquidity of funds will increase.

Reduction of Interest will bring more capital to the stock market, which will help stock prices rise. It also will stimulate the development of the real estate industry, promote the expansion of corporate loans for reproduction, and encourage consumers to borrow money to purchase large-scale goods, which will gradually heat the economy.

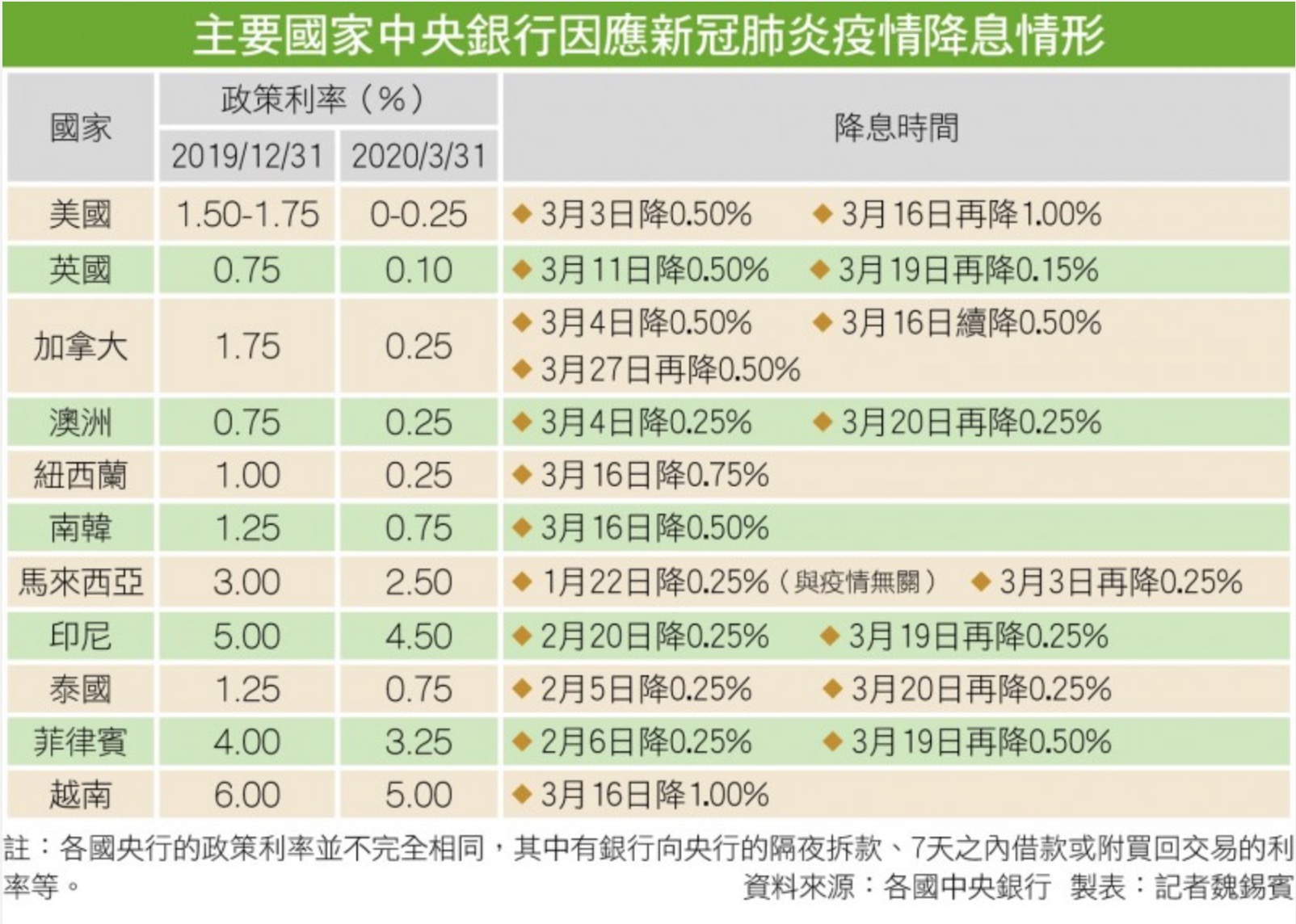

In an extraordinary attempt to contain the coronavirus’s economic fallout, the Federal Reserve slashed interest rates by a full percentage point to near zero. Subsequently, central banks in many countries and regions also adopted interest rate cuts or other loose monetary policies. According to incomplete statistics, in the first half of 2020, central banks around the world cut interest rates more than 200 times.

Major countries' central bank cut interest rates in 2020

Why does the Central Bank Choose cut rate

For most central banks, the primary responsibility is to ensure employment and reasonable inflation. The central bank cut interest rates to increase capital liquidity, promote consumption, and benefit the stock market.

The federal funds rate is important because many other rates, domestic and international, are linked directly to it or move closely with it.

When the Fed "cuts rates," this refers to a decision by the FOMC to reduce the federal fund's target rate. The target rate is a guideline for the actual rate that banks charge each other on overnight reserve loans. Rates on interbank loans are negotiated by the individual banks and, usually, stay close to the target rate. The target rate may also be referred to as the "federal funds rate" or the "nominal rate."

The federal funds rate is a monetary policy tool used to achieve the Fed's goals of price stability (low inflation) and sustainable economic growth. Changing the federal funds rate influences the money supply, beginning with banks, and eventually trickling down to consumers.

The Fed lowers interest rates to stimulate economic growth. Lower financing costs can encourage borrowing and investing. However, when rates are too low, they can spur excessive growth and perhaps inflation. Inflation eats away at purchasing power and could undermine the sustainability of the desired economic expansion.

On the other hand, when there is too much growth, the Fed will raise interest rates. Rate increases are used to slow inflation and return growth to more sustainable levels. Rates cannot get too high, because more expensive financing could lead the economy into a period of slow growth or even contraction.

The Fed adjusts this interest rate to achieve one goal-to maintain maximum employment and price stability in the United States. When the economy is weak, interest rates will be cut to inject more liquidity into the market to stimulate the economy. Raise interest rates when the economy is strong, reduce the money supply, and prevent the economy from overheating.

What Is the Impact of the Central Bank’s Reduction of Interest?

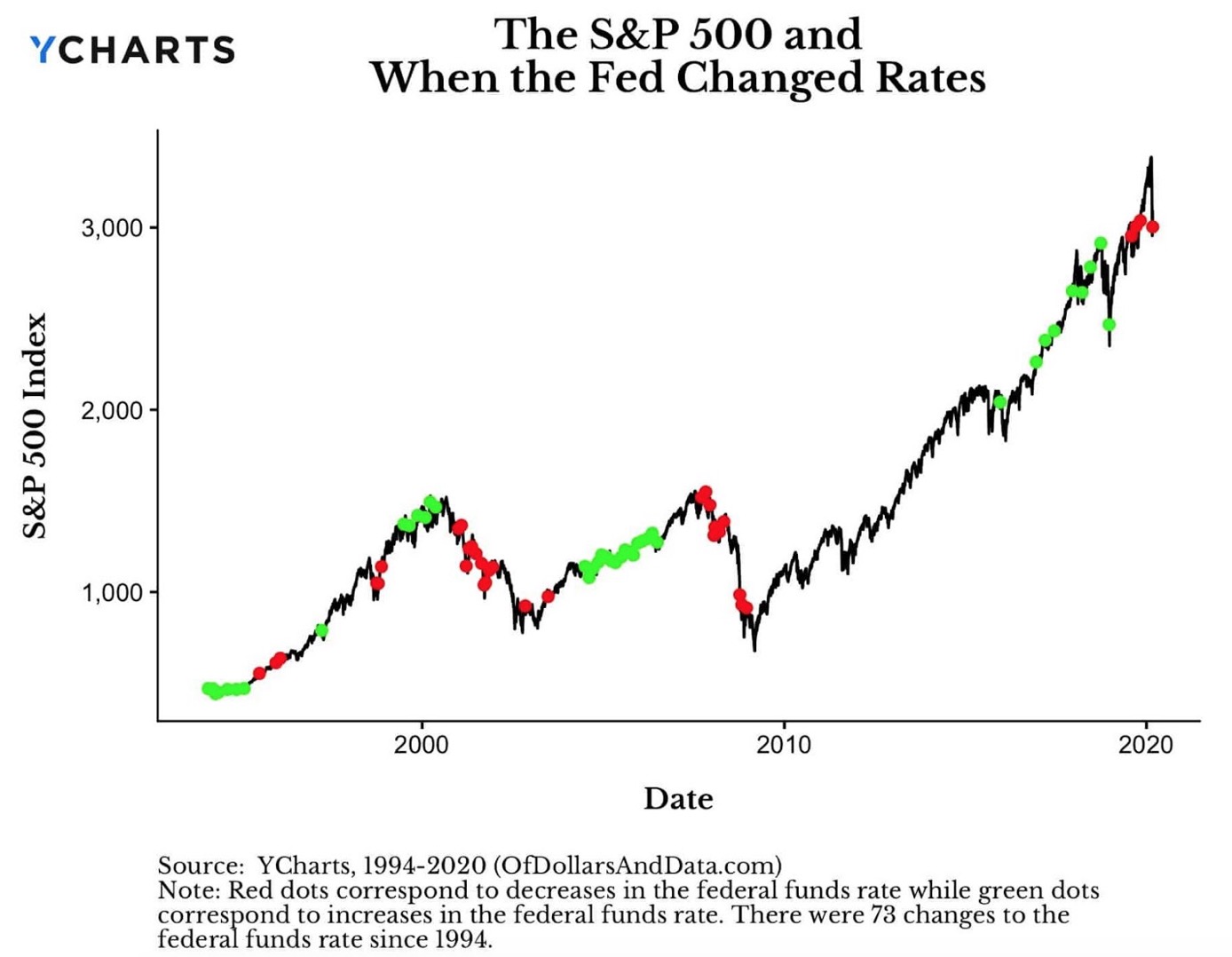

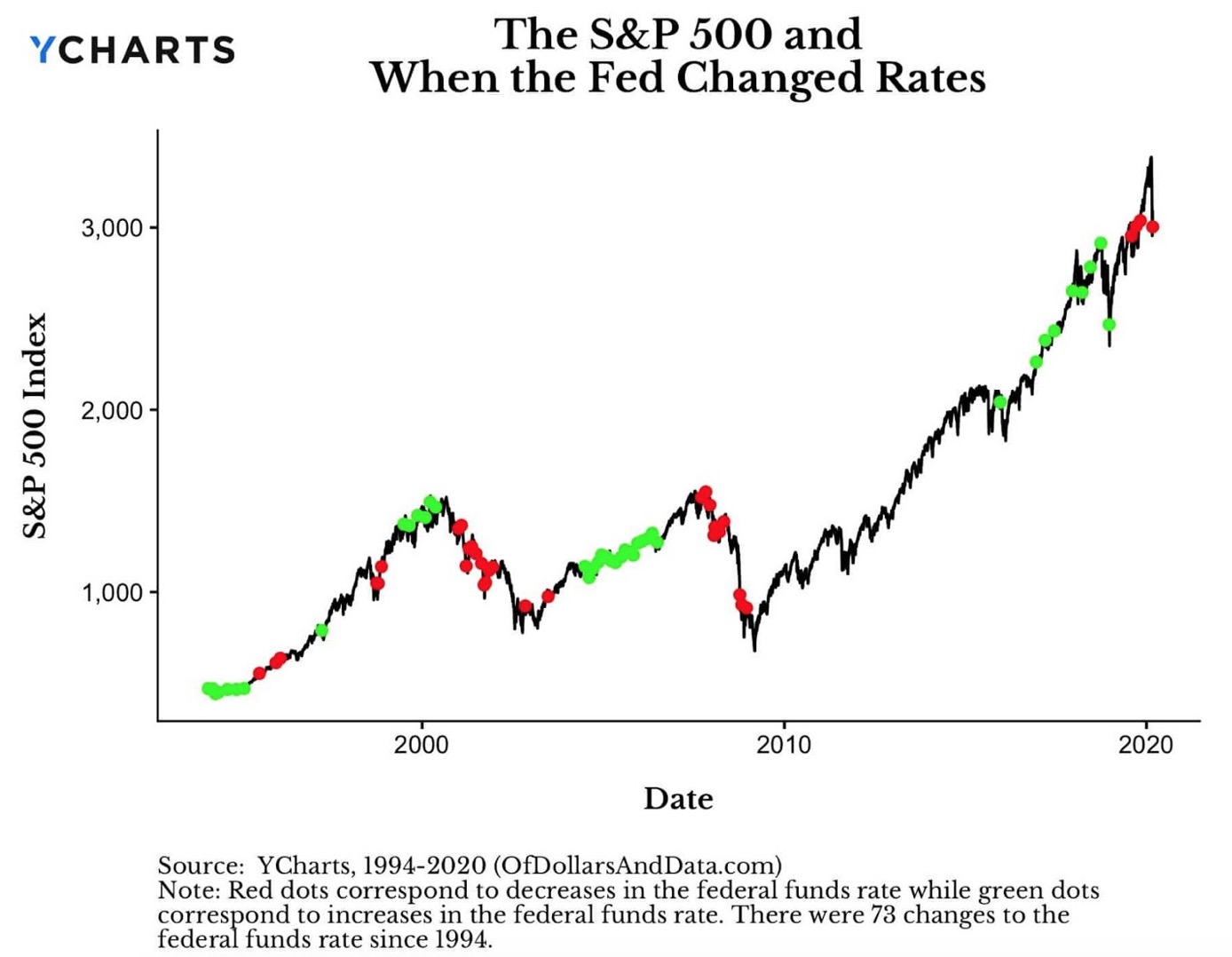

1. Stock traders almost always rejoice when the Fed cuts interest rates

Due to the price of the currency has fallen, the operating costs of companies have been reduced, and the cost of financing in the stock market has also been reduced. This will stimulate more funds to flow to the stock market and also stimulate corporate investment.

For example, in March this year, the Federal Reserve announced a 50 basis point cut in interest rates. Affected by the news of the sharp rate cut, US stocks, which had fallen on the same day, immediately rose straight, but they did not last long and the trend was fluctuating. Not every time the Fed cuts interest rates, the stock market is bound to rise. However, situations like this have further deepened the belief of the majority of investors that if the central bank cuts interest rates, it will be good news for the stock market.

2. Interest Rates Have an Effect on Consumer Behaviour

When rates go down, borrowing becomes cheaper, making large purchases on credit more affordable, such as home mortgages, auto loans, and credit card expenses.

When rates go up, borrowing is more expensive, putting a damper on consumption. Higher rates, however, do benefit savers who get more favorable interest on deposit accounts.

i. The decrease in deposit interest and the increase in domestic inflation rate have reduced the risk-free investment income and will force depositors to use their deposits for consumption and investment.

ii. The central bank's reduction of interest will reduce loan interest rates, reduce corporate financing costs, and increase profit margins. Enterprises will increase investment, expand production scale, purchase raw materials, machinery and equipment, build factories, etc. These demands can all drive consumption.

iii. Reduction of interest leads to over-issuance of currency, which will also lead to a downward trend in the interest rate band of the national debt. The depreciation of the domestic currency is conducive to promoting exports. Besides, the depreciation of the domestic currency causes the price of imported goods to rise, and domestic consumption is more inclined to buy the domestic product.

English

English

简体中文

简体中文

Tiếng Việt

Tiếng Việt

Malay

Malay

Indonesia

Indonesia

Deutsch

Deutsch

Français

Français

Español

Español

Italiano

Italiano