Where to Take Profit When Day Trading

2021-07-05A profit target is a pre-determined price level where you will close the trade. Day traders should always know why and how they will get out of a trade. There are multiple ways to determine where to get out.

1. Calculate profit target of chart pattern

Chart patterns, when they occur, can be used to estimate how far the price could move once the price moves out of the pattern.

As shown in the figure, the Double Top Pattern in 30 minute chart in UKoil in March 13, 2020, the pattern is $2.695 high. Subtract $2.695 from Entry point $31.720 to get a profit target price of $29.025.

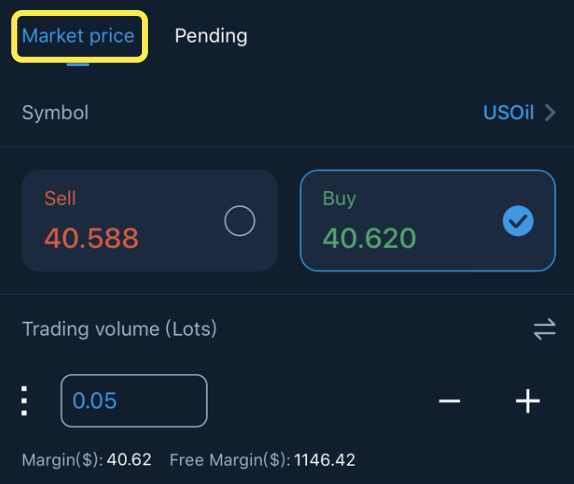

Then you can take profit order on price $29.025. When the price reach the target, your position would close automatically.

2. Manually move your take profit setting

Place a stop loss and a take profit based on objective data, such as common tendencies on the price chart.

you want to extract as much profit potential as possible based on the tendencies of the market you are trading, So you should move the two settings up or down manually.

If you take the long positions, move up both stop loss and take profit price while the tendency goes up.

If you take the short positions, move down both stop loss and take profit price while the tendency goes down.

This method requires you to spend time looking at the price chart.

3. A fixed risk ratio

One of the simplest close out is to use a fixed risk ratio. The profit target is set at a multiple of this, for example, 2:1. If you enter a short trade of BTCUSD at $5300 and determine your stop loss should be placed at $5170. the risk fund is $130, If you opt to use a 2:1 risk, then your profit target would be placed $5560, double space from your risk.

When starting out, the fixed risk method works well. Use a 1.5 or 2:1 reward to risk, and see it how it works out.

Placing profit targets and close out requires skill. Choose one of your favorite and practice step by step.

English

English

简体中文

简体中文

Tiếng Việt

Tiếng Việt

Malay

Malay

Indonesia

Indonesia

Deutsch

Deutsch

Français

Français

Español

Español

Italiano

Italiano